how are property taxes calculated in broward county florida

If you do not want your e-mail address. Some of these variables include.

2018 Property Tax Trim Notices For Broward County Mailed Tommy Realtor

If you would like to calculate the estimated taxes on a specific property use the tax.

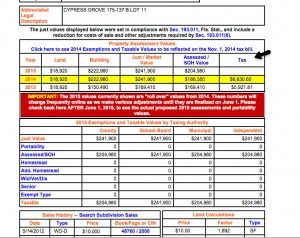

. See detailed property tax information from the sample report for 10924 NW 29 Ct Broward County FL. The Broward County Property Appraisers Office assesses the value of your property and applies eligible tax exemptions that can lower the taxable value of your property. 2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607.

Search all services we offer. Property Tax Appraisals The Broward County Tax Assessor will appraise the taxable value of each property in his jurisdiction on a yearly basis based on the features of the property and the fair market value of comparable properties in the same neighbourhood. Broward County calculates the property tax due based on the fair market value of the home or property in question as determined by the Broward County Property Tax Assessor.

Taxes are determined at local levels being used for schools fire and police protection and other. This tax estimator is based on the average millage rate of all Broward municipalities. Usually property taxes are not levied by the federal government.

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Apply for Business Tax account Run a Business Tax report Run a Real Estate report Run a Tangible Property report. Each property is individually t each year and any improvements or additions made to your property may increase its appraised value. According to the Broward County property appraiser the taxable value of a property is multiplied by the number of mills imposed to calculate property taxes.

Buker 954-357-5378 Records Taxes and Treasury Division EMAIL. 3 Oversee property tax administration. Lands Available for Taxes LAFT Latest Tax Deed Sale Information.

NEW HOMEBUYERS TAX ESTIMATOR. The list is sorted by median property tax in dollars by default. The more valuable the land the higher the property taxes.

When it comes to real estate property taxes are almost always based on the value of the land. The estimated tax amount using this calculator is based upon the average Millage Rate of 200131 mills or 200131 and not the millage rate for a specific property. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Apply for Business Tax account Run a Business Tax report Run a Real Estate report Run a Tangible Property report. The average Florida homeowner pays 1752 each year in real property taxes although that amount varies between counties. Florida real property tax rates are implemented in millage rates which is 110 of a percent.

November 15 2016 MEDIA CONTACT. You can sort by any column available by clicking the arrows in the header row. Houses 1 days ago The median property tax in Broward County Florida is 2664 per year for a home worth the median value of 247500.

How Property Tax is Calculated in Broward County Florida. Broward County Property Appraisers Office - Contact our office at 9543576830. You can see the differences when you claim this property as your primary residence and receive the Homestead Exemption or other exemptions based on various issues.

The Florida Property Tax Statute and the Florida State Consitution are the main legal documents regarding taxation in the State of Florida. Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business. Under Florida law e-mail addresses are public records.

This applies to everywhere in the US. Tax payments for current tax bills are posted according to their postmark. Cities school districts and county departments in Miami-Dade and Broward Counties may set their own millage all of which are added up to determine the total millage rate.

Property taxes in Florida are implemented in millage rates. This interactive table ranks Floridas counties by median property tax in dollars percentage of home value and percentage of median income. A millage rate is one tenth of a percent which equates to 1 in taxes for every 1000 in home value.

Having trouble viewing our website. 1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually. All property taxes become due November 1st must be paid no later than March 31st and become delinquent if not paid before April 1st Discounts are applied to tax bills paid in full between November 1st and February 28th November 4.

How are property tax bills calculated in Broward County FL. Our Broward County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Florida and across the entire United States. Find the assessed value of the property being taxed.

The millage rate is a dollar amount per 1000 of a homes taxable property value. The amount of property taxes you owe in Broward County is determined by two things. The assessed value of the property and the tax rate.

Typically Broward County Florida property taxes are decided as a percentage of the propertys value. To calculate the property tax use the following steps. Median property tax is 177300.

Typically property taxes are imposed by state and local governments. Banner Image Missing County Announces Convenient Way to Pay Property Taxes - One-day-only express tax payment drop-off service November 30th - DATE. Broward County collects on average 108 of a propertys assessed fair market value as property tax.

Broward County Florida Property Taxes - 2022. A number of different authorities including counties municipalities school. This equates to 1 in taxes for every 1000 in home value.

Fire or Going Out Of Business Sale Permits.

Will Broward Miami Dade Property Taxes Go Up In 2021 Miami Herald

Property Tax Search Taxsys Broward County Records Taxes Treasury Div

Soon After Taking The Oath Dehradun S New Mayor Sunil Uniyal Gama Hinted To Revise House Tax In The City Property Tax Tax Consulting Tax Payment

Broward County Property Taxes What You May Not Know

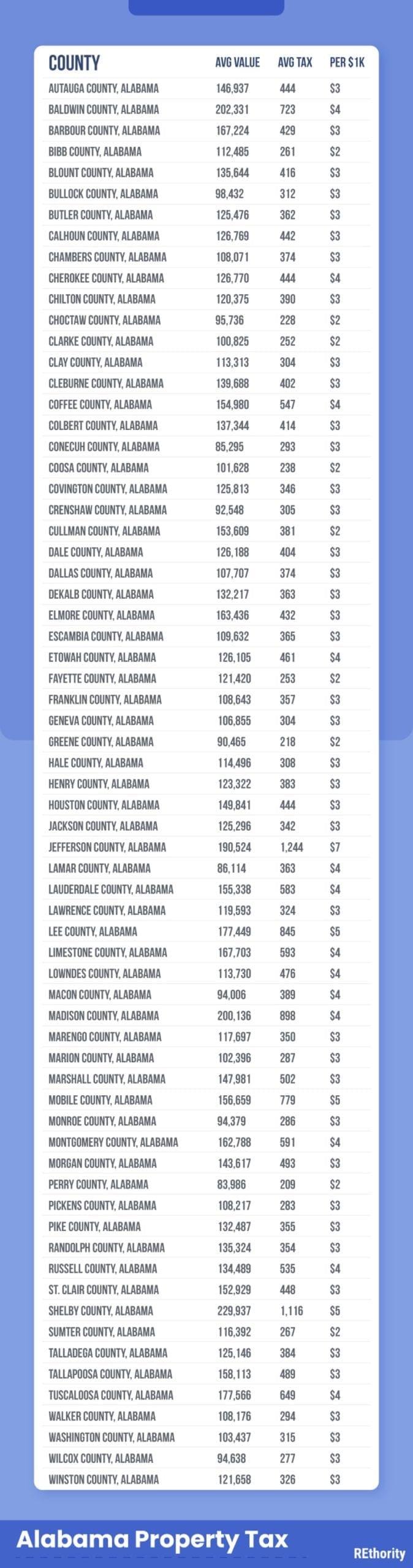

Property Tax By County Property Tax Calculator Rethority

Fort Lauderdale Property Tax Living Las Olas

What Is Florida County Tangible Personal Property Tax

How To Lower Property Taxes 7 Tips Quicken Loans

Parkland Residents May Pay Higher Property Taxes In 2022 Parkland Talk

Fort Lauderdale Property Tax Living Las Olas

Your Guide To Prorated Taxes In A Real Estate Transaction

How Florida Property Tax Valuation Works Property Tax Adjustments Appeals P A

Florida Property Tax H R Block

How To Find Tax Delinquent Properties In Your Area Rethority

How Much House Can I Afford Insider Tips And Home Affordability Calculator Mortgage Payment Calculator Mortgage Free Mortgage Calculator